targa resources stock analysis

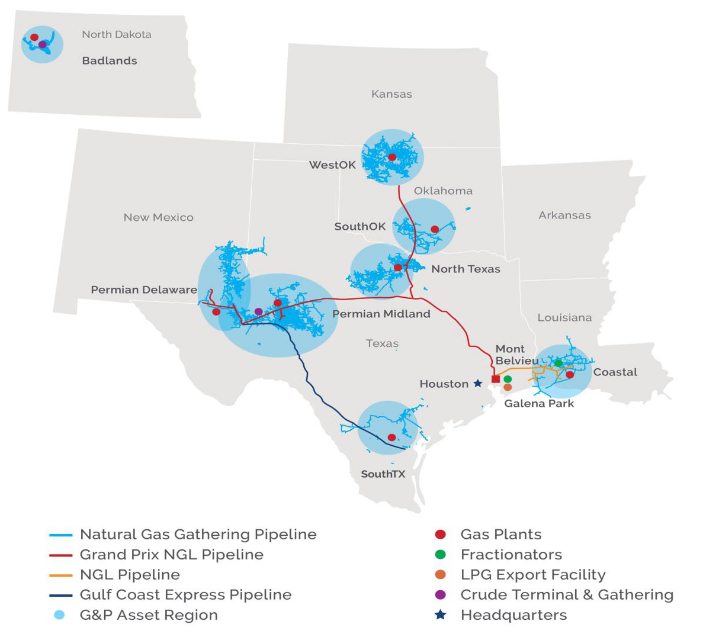

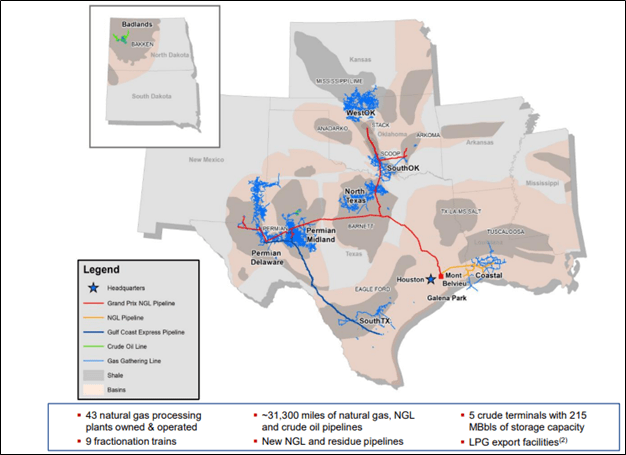

Targa Resources is a midstream firm that primarily operates gathering and processing assets with substantial positions in the Permian Stack Scoop and Bakken plays. See our latest analysis for Targa.

Targa Resources Corp Nyse Trgp Seasonal Chart Equity Clock

Diversify your portfolio discover undervalued companies that may have growth potential.

. Access detailed information about the Targa Resources Inc TRGP stock including Price Charts Technical Analysis Historical data Targa Resources Reports and more. 5 rows Real time Targa Resources TRGP stock price quote stock graph news analysis. Targa Resources TRGP gets an Overall Rank of.

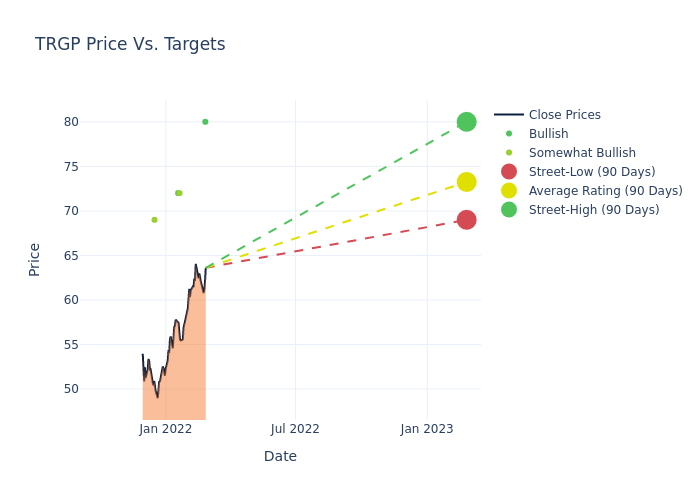

Targa Resources Corp. Buy News Press Releases Conversation Why Targa Resources Inc. Based on the Targa Resources Corp stock forecasts from 10 analysts the average analyst target price for Targa Resources Corp is USD 6714 over the next 12 months.

Price Target 6992 854 upside Analyst Consensus. About the company Rewards Trading at 4 below our estimate of its fair value Earnings are forecast to grow 4582 per year. Wall Street Stock Market Finance report prediction for the future.

Their forecasts range from 3700 to 8000. 13 equities research analysts have issued 1-year target prices for Targa Resources stock. Targa Resources Corp Stock Market info Recommendations.

TRGP Company Profile Overview Stock Analysis Targa Resources Corp. Data is currently not available. The Targa Resources Inc stock price fell by -083 on the last day Thursday 17th Feb 2022 from 6298 to 6246.

Youll find the Targa Resources share forecasts stock quote and buy sell signals belowAccording to present data Targa Resourcess TRGP shares and potentially its market environment have been in a bullish. It operates in two segments Gathering and. Technical Analysis Summary for Targa Resources with Moving Average Stochastics MACD RSI Average Volume.

Buy or sell Targa Resources stock. Some Targa Resources Corp. It has 813000 barrels a day.

Common Stock TRGP Nasdaq Listed. Targa Resources Corp TRGP Stock Analysis. Analyze Targa Resources Corp together with its subsidiary Targa Resources Partners LP owns operates acquires and develops a portfolio of midstream energy assets in North America.

Targa Resources is a midstream firm that primarily operates gathering and processing assets with substantial positions in. On average they anticipate Targa Resources stock price to reach 6415 in the next twelve months. TRGP Company Description Targa Resources Corp together with its subsidiary Targa Resources Partners LP owns operates acquires and develops a portfolio of midstream energy assets in North America.

Shareholders may be a little concerned to see that the Chief Commercial Officer Robert Muraro recently sold a substantial US672k worth of stock at a price of US6817 per shareHowever its crucial to note that they remain very much invested in the stock and that sale only reduced their holding by 48. TRGP is a Top Value Stock for the Long-Term. Rating as of Dec 24 2021.

-096 -157 DATA AS OF Feb 03 2022 157. Trading strategies financial analysis commentaries and investment guidance for TARGA RESOURCES CORP. 11 rows TRGP Stock Analysis Overview What this means.

TRGP stock analyst estimates including earnings and revenue EPS. Targa Resources Corps average analyst rating is Strong Buy. 5 rows See Targa Resources Inc.

Ad Compare the value of stocks by region country or industry with GlobalAnalyst. Raymond James Lifts Targa Resources Price Target to 80 From 70 Strong Buy Rating Kept. This suggests that the stock has a possible downside of 51.

According to 28 analysts the average rating for TRGP stock is Buy The 12-month stock price forecast is 6992 which is an increase of 854 from the latest price. Reports Fourth Quarter and Full Year 2021 Financial Results and Provides 2022 Operational and Financial Outlook. The price has been going up and down for this period and there has been a 355 gain for the last 2 weeks.

Quote Stock Analysis News Price vs Fair Value Sustainability Trailing. During the day the stock fluctuated 171 from a day low at 6244 to a day high of 6351. TRGP fundamental analysis TRGPStock Overview Targa Resources Corp together with its subsidiary Targa Resources Partners LP owns operates acquires and develops a portfolio of midstream energy assets in North America.

Over the past 3 months 5 analysts have published their opinion on Targa Resources NYSETRGP stockThese analysts are typically employed by large Wall Street banks and tasked with understanding.

The 4 9 Return This Week Takes Targa Resources Nyse Trgp Shareholders One Year Gains To 111 Simply Wall St News

Targa Resources Corp Nyse Trgp Seasonal Chart Equity Clock

Targa Resources Stock Back On Track Focused Performing Strongly Nyse Trgp Seeking Alpha

Targa Resources Stock Back On Track Focused Performing Strongly Nyse Trgp Seeking Alpha

Should You Buy Targa Resources Trgp Ahead Of Earnings

Expert Ratings For Targa Resources

Targa Resources Starting To Make Sense For New Money Nyse Trgp Seeking Alpha

Targa Resources Corp Nyse Trgp Seasonal Chart Equity Clock

Targa Resources Stock Back On Track Focused Performing Strongly Nyse Trgp Seeking Alpha

Targa Resources Stock Forecast Down To 62 358 Usd Trgp Stock Price Prediction Long Term Short Term Share Revenue Prognosis With Smart Technical Analysis

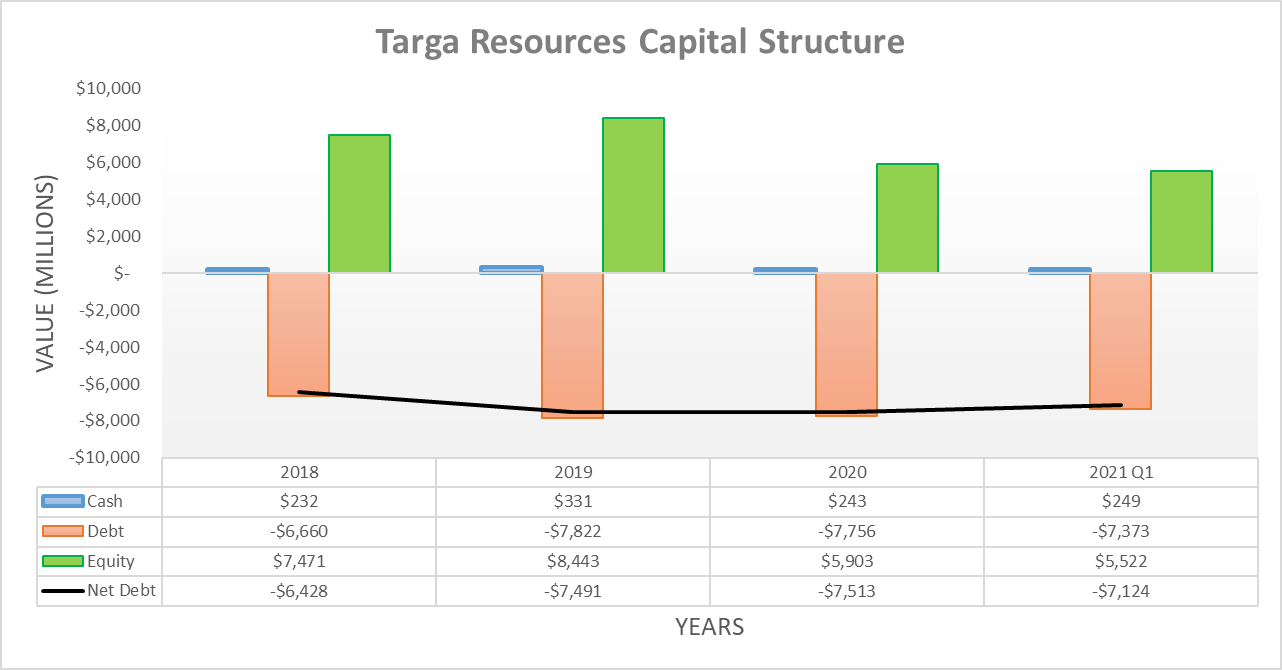

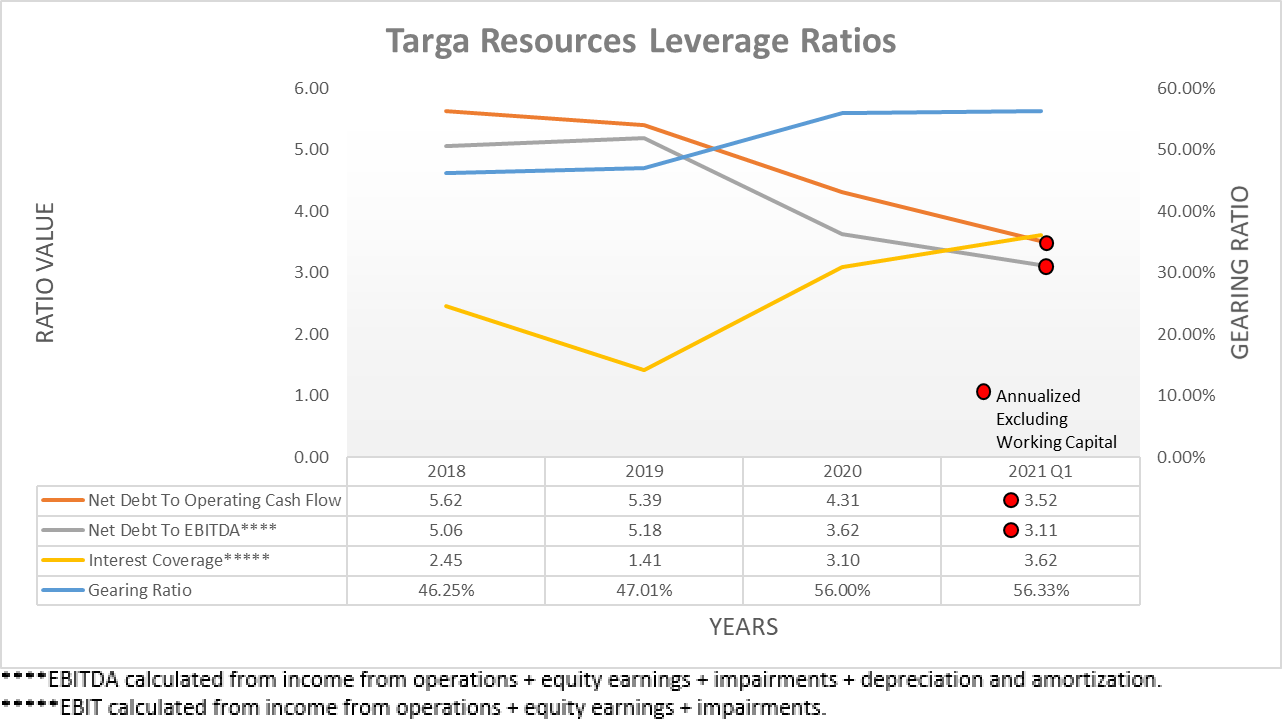

Targa Resources Focusing On Deleveraging Didn T Last Long Nyse Trgp Seeking Alpha

Stock Performance Quote Targa Resources Corp

Targa Resources Nyse Trgp 60 Upside Potential In Next 3 Years Seeking Alpha

Targa Resources Corp Nyse Trgp Seasonal Chart Equity Clock

Technical Analysis Of Targa Resources Inc Nyse Trgp Tradingview